YSR Bima – Objective of the Scheme

The main Objective of the scheme is to provide relief to the bereaved families of BPL in case of death or disability of their Primary Bread Earners to mitigate the financial impact due to the sudden loss of the Primary source of income.

The death or disability due to accident of a Primary Bread Earner results in misery to his/her family with hardship and reduced earnings and excessive medical expenditure relating to the accident. Hence, there is every need to provide accidental death and disability insurance to the Primary Bread Earner of BPL families towards social security. Further, even natural death of a Primary Bread Earner of the BPL family results in undue hardship to the surviving family members who are to be provided with some relief. Thus, the State Government has introduced the YSR- Bima scheme.

Salient Features of the Scheme

All Primary Bread earners belonging to BPL families in the State, in the age group of 18 to 70 years are eligible to be enrolled as beneficiaries of new YSR- Bima Scheme.

Benefits under the new YSR -Bima Scheme are as follows:

i. Rs.1.00 lakh relief amount to the nominees of the beneficiaries towards Natural Death in the age group of 18-50 years under YSR Bima Scheme will be paid directly by the Government through GV/WV & VS/WS Department.

ii. Rs.5.00 lakh relief amount will be paid to the beneficiaries towards Accidental Death/Permanent Disability in the age group of 18-70 years through insurance company. Insurance coverage will be made under suitable Group Insurance Scheme by the selected Insurance Company. The total premium for the Scheme shall be paid by the Government.

Eligibility Criteria: The members should be aged between 18 completed years and 70 years. He / She should be from Below Poverty line. He / She should be Primary Bread earning member. The decision as to the eligibility of the member for the enrolment into the scheme is fully vested with the Nodal Agency. The Nodal Agency will however, verify the eligibility of the member as per the above criteria.

Verification of Age: The Nodal Agency has to satisfy that the member covered under the Scheme is in the respective age group as desired by the scheme. Age admission will be done based on Aadhar or any other document as specified in the notification under section 7 of the Aadhar Act.

Appointment of Nominee: Every insured member shall appoint one or more from the spouse or children or dependents to be the nominee or nominees in accordance with Section 39 of Insurance Act 1938. In the event of death of the insured member while being covered under the Scheme, the benefits of insurance cover as assured on his life will be paid to the nominee. If the insured member does not have a spouse or child/children or dependents, then he shall appoint his legal representative to be the nominee. The Data regarding nomination will be maintained by the Implementing Agency and they shall submit the details of nomination or legal heirs to Insurance Companies for settlement of claims. In case the nominee is a minor, then the insured member shall appoint an Appointee to receive the benefit of assurance.

Servicing of the Scheme: The Nodal Agency will coordinate with all concerned Implementing Agencies to adopt a strong IT based system to service the Scheme. The implementing agencies will maintain centralized data base of the insured members. The settlement of claims would be subject to implementing Agency submitting Claim form, claim-cumdischarge form and copy of the Death Certificate, age proof of member as required by the insurance company in accordance with policy terms, conditions & MoU. Details of nominee like the Aadhar number and bank account to which the claim proceeds are to be credited, and other details as required by insurance company to process the claim.

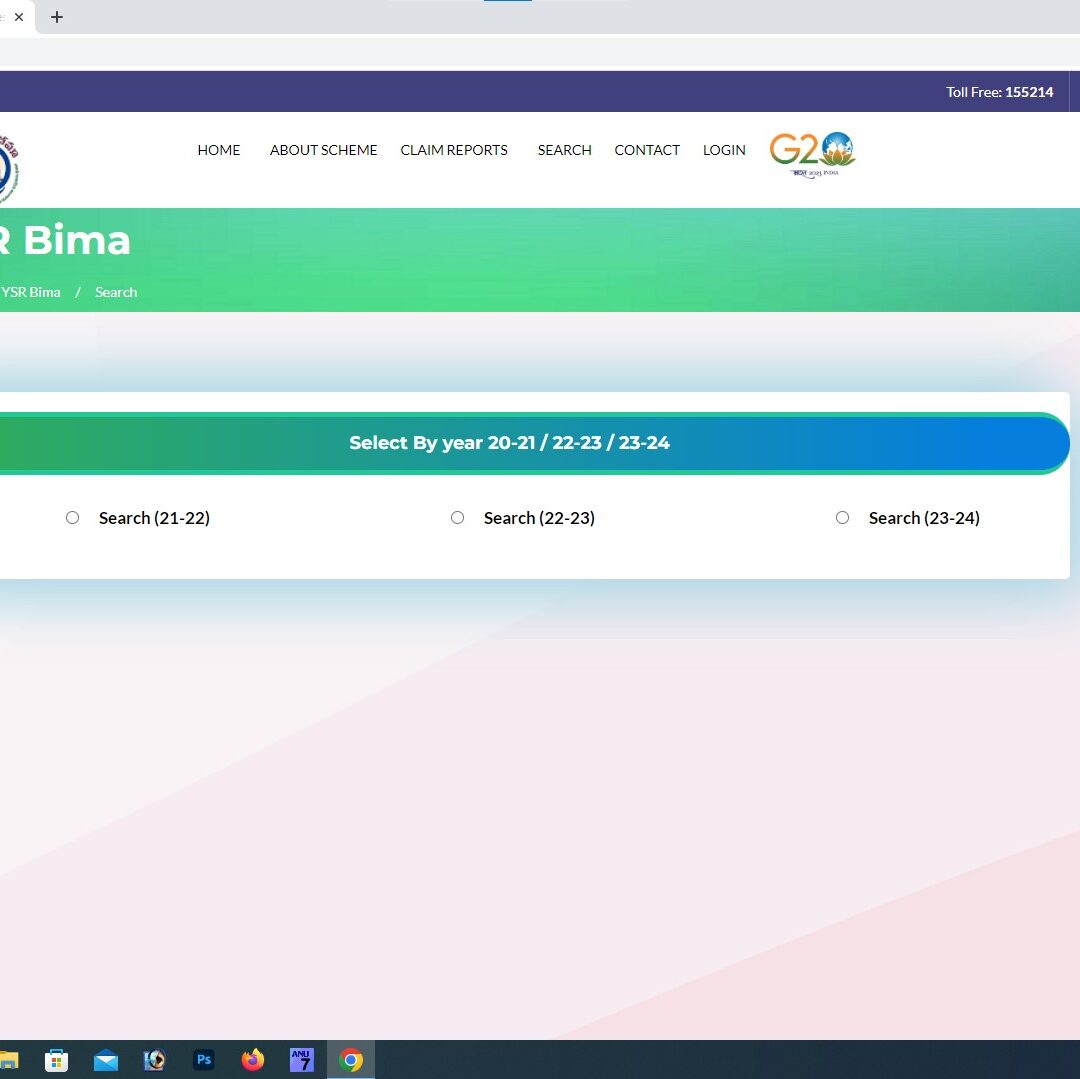

Check Your Status Click Here